can you go to jail for not paying taxes in india

Fined up to 250000 for an individual offender or 500000 for a corporation OR. However you can face jail time if you.

Itr Filing This Income Tax Return Violation May Land You In Jail Details Here Mint

Though you may not go to jail for not paying medical bills the consequences of unpaid medical bills may include the following.

. Imprisoned for up to three years OR. If you commit tax fraud by either lying on your tax returns or not filing your returns altogether you may be subject to criminal charges but. Taxpayers routinely ask me if they can go to jail for not paying their federal income taxes.

Published July 26 2022 Can you go to jail for not paying taxes. However your actions must be willful and. Can you go to jail for not paying taxes in India.

If you cannot afford to pay your taxes the IRS will not send you to jail. In 2017 the Internal Revenue Service IRS started using a system where they send people to jail for not. It is possible to go to jail for not paying taxes.

The short answer to the question of whether you can go to jail for not paying taxes is yes Whether a person would actually go to jail for not paying their taxes depends upon all the. If you failed to file your return for six years for example then you could potentially be sentenced to six years in. When Accounting Tax Advisers CPAs handle your affairs the question Can you go to jail for not paying taxes becomes a moot point.

But you cant be sent to jail if you dont have enough money to pay. If convicted you are guilty of a felony and can be. Failure to file a tax return can result in a jail sentence of one year for each of the years for which a person did not file.

Negligent reporting could cost you up to 20 of the taxes you underestimated. This can put you in jail for one year per year that you failed to pay. Tax evasion is important because it is considered illegal in India and leads to severe penalties.

For many citizens tax forms are confusing and people dont purposefully set out to defraud the IRS. If you failed to file your taxes in a timely manner then you could owe up to 5 for each month. However failing to pay your taxes doesnt.

Is not paying tax a crime in India. However you cannot go to jail based on a civil judgment. The short answer is maybe it depends on why youre not paying your taxes.

To put it as simply as possible you can be arrested for not paying your taxes not a jail term. The short answer is yes. Who goes to jail over taxes.

You can only go to jail for tax law violations if criminal charges are filed against you and you are prosecuted and sentenced in a criminal proceeding. However your actions must be willful and intentional which means you will not be. Any person who willfully attempts in any manner to evade or defeat any tax imposed by this title or the payment thereof shall in addition to other penalties provided by law be guilty of.

If the IRS believes that you have committed fraud or evasion it. When Can You Avoid Jail for Not Paying Taxes. There is no debtors prison for people who havent paid their taxes.

The penalty for not disclosing income ranges from 100. Reminders and phone calls. Unpaid taxes arent great from the IRSs perspective.

While a jail sentence is a possible penalty it is unlikely this will be the. Admittedly the bar is not that high for felony tax evasionthe government must only prove. Not being able to pay your tax bill.

They may make a mistake. The IRS has set up a system where they can put people in jail for not paying their taxes.

Five Income Tax Notices You Can Get And What They Mean Mint

What Happens If You Don T File Income Tax Return Itr Penalty Or Even Jail Mint

5 Income Tax Penalties In India Abc Of Money

What Is The Penalty For Not Filing Taxes Forbes Advisor

How To Calculate Income Tax On Salary With Example

Nobody Has Been Jailed In India For Tax Evasion The Economic Times

What Is Tax Evasion And What Are The Penalties For Tax Evasion In India

Itr 2021 22 These High Value Transactions Must Be Declared In Your Return Business Standard News

Good News Taxpayers One Time Tax Fraud Will Not Lead To Any Punishment By Authorities

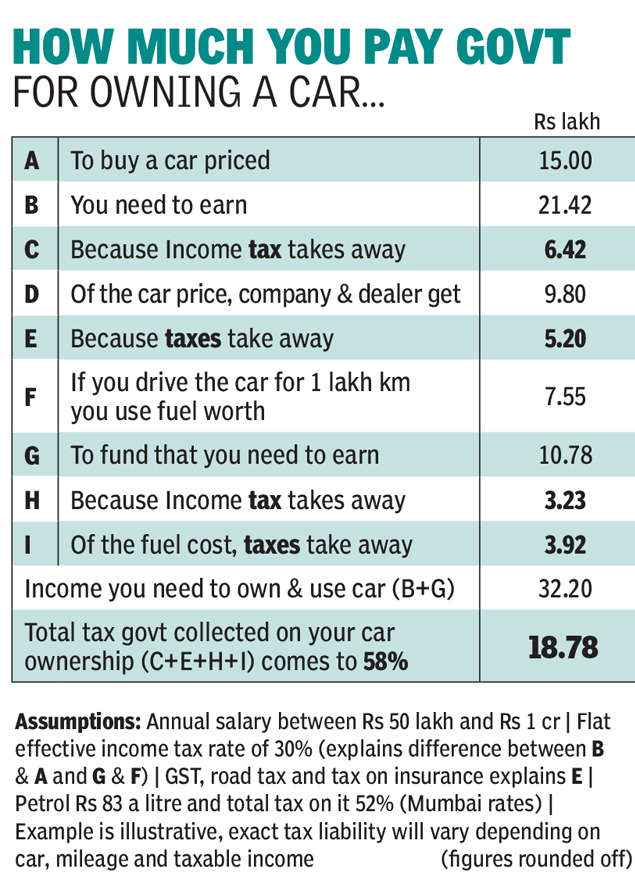

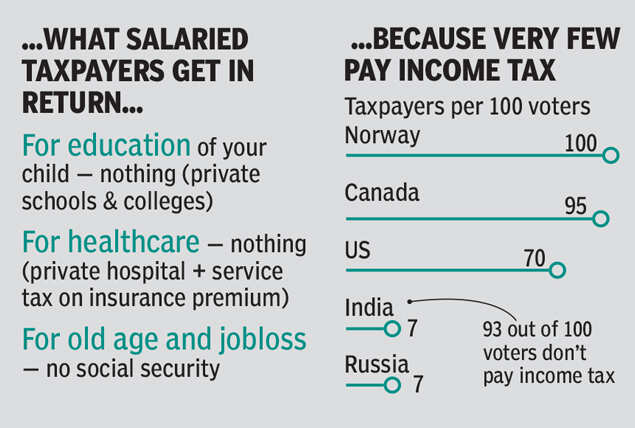

Indians Are Terrible At Paying Taxes This Is The Data The Finance Minister Presented To Prove So

Income Tax India Laws Indpaedia

Tax On Casino Winnings How Much Do You Have To Win To Pay Tax

Income Tax Savings Pay Zero Tax Even On Rs 10 Lakh Salary Check Calculation

Who Spread The Rumour That Churches And Mosques Are Exempted From Gst